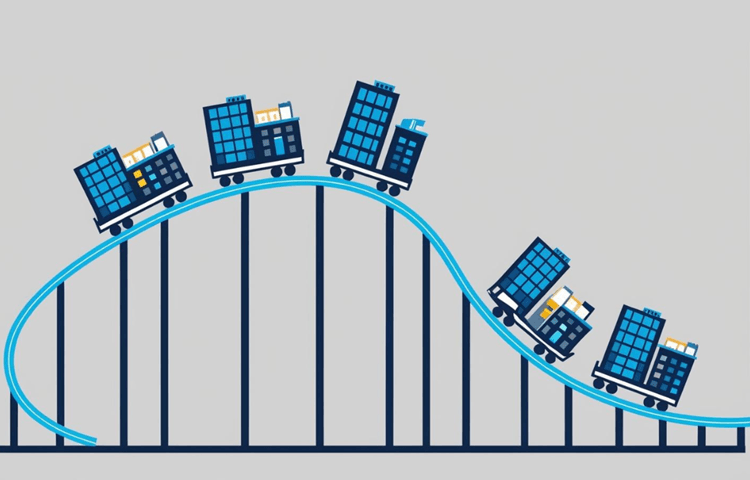

The fintech industry has long been celebrated for its rapid growth and innovation. However, like many sectors, it has not been immune to the global economic slowdown. With market volatility, shifting investor confidence, and growing uncertainty, the fintech sector is facing a unique set of challenges. These challenges are particularly felt within the realm of HR executive search and talent management, where the need to balance business objectives with employee well-being and company culture has become even more critical.

At Aston Fisher, we are a leading UK-based executive search firm, working in a number of sectors including fintech. As specialists we are able to advise and support companies in developing and strengthening their talent pipelines to weather more turbulent times. In this blog, we explore how HR and talent professionals within fintech companies are addressing these specific challenges. We also suggest solutions for improving both talent management and organisational strategy:

- Cost-Cutting Measures and Workforce Reduction

- Employee Morale and Retention in Uncertain Times

- Financial Constraints on Compensation and Benefits

- Shifting Focus on Employee Skill Development

- Managing Remote Work and Employee Well-Being

- Re-evaluating Company Culture in the Face of Financial Strain

Cost-Cutting Measures and Workforce Reduction

One of the most immediate impacts of a market downturn is the need for companies to reassess their financials. In many cases, this means implementing cost-cutting measures, which often include reducing the workforce. For fintech companies that have previously enjoyed rapid growth, the pressure to reduce headcount can be especially challenging.

HR teams, often working in partnership with executive search professionals, are tasked with managing layoffs in a way that minimises damage to morale and preserves the company’s long-term vision. While layoffs may be necessary during economic contractions, HR must ensure that the process is handled with empathy, transparency, and fairness. By leveraging insights from HR executive search experts, companies can also strategically rebuild their teams once the market recovers.

Key Solutions:

- Ensure clear and transparent communication with employees about the company’s financial situation and potential layoffs.

- Offer severance packages and career transition support to help displaced employees find new opportunities quickly.

- Foster a culture of trust and transparency to mitigate the negative impact on remaining employees.

Employee Morale and Retention in Uncertain Times

During challenging economic times, uncertainty surrounding the company’s financial health can lead to anxiety among employees. Concerns over job security, changes in compensation, and the overall future of the company can lead to lower morale and increased staff turnover. Employees who feel uncertain about their future may well seek more stable opportunities, further straining the organisation’s talent pipeline.

For HR teams, retaining top talent requires a proactive approach. This includes fostering a sense of purpose and connection, supported by a clear strategy for managing periods of uncertainty. Collaboration with fintech executive search firms can also provide valuable insights into industry trends and retention strategies.

Key Solutions:

- Maintain open lines of communication, offering regular updates on the company’s strategic direction.

- Reinforce the company’s mission and vision to help employees feel connected to a larger purpose.

- Provide non-monetary incentives such as recognition programs, professional development opportunities, and flexible work arrangements.

Financial Constraints on Compensation and Benefits

Volatile market conditions often forces fintech firms to reassess their compensation and benefits packages. For organisations that previously attracted top talent with generous salaries and perks, scaling back can lead to dissatisfaction among employees. HR executive search professionals note that retaining talent during such times requires a strategic balance between both financial and non-financial incentives.

Key Solutions:

- Be transparent about the company’s financial position to explain changes in compensation.

- Offer alternative benefits such as professional development opportunities, mental health support, and wellness initiatives.

- Explore creative solutions like performance-based bonuses or retention bonuses tied to the company’s recovery.

Shifting Focus on Employee Skill Development

As the fintech sector grapples with adverse trading conditions, companies are increasingly relying on their existing workforce to adapt to new roles or responsibilities. Rather than bringing in new hires, HR teams are prioritising upskilling and reskilling employees to ensure their adaptability.

As fintech executive search specialists we always recommend conducting skill gap analyses to identify areas where development is needed. By investing in their workforce, companies can then strengthen their talent pipeline while fostering employee loyalty and engagement.

Key Solutions:

- Conduct skill gap analyses to identify opportunities for upskilling or reskilling employees.

- Offer internal training programs, mentorship opportunities, or partnerships with learning platforms.

- Encourage cross-functional collaboration to broaden employee skill sets and adaptability.

Managing Remote Work and Employee Well-Being

The shift to remote work, accelerated by the pandemic, remains a challenge in the fintech sector. While remote work offers flexibility, it also introduces new difficulties in managing employee well-being and productivity. Fintech firms must strike a balance between cost constraints and the need to support remote employees effectively.

Key Solutions:

- Provide mental health support through Employee Assistance Programs (EAPs) or access to counselling services.

- Promote a healthy work-life balance by encouraging employees to disconnect from work.

- Implement virtual team-building activities to foster a sense of community and morale.

Re-evaluating Company Culture in the Face of Financial Strain

Company culture in the fintech industry has traditionally focused on innovation and agility. However, during more challenging financial times, maintaining a strong and cohesive culture becomes even more important. HR professionals, often working alongside executive search experts, play a key role in aligning the company’s culture with its current realities.

Key Solutions:

- Reinforce company values through internal communication and leadership engagement.

- Focus on inclusion and belonging to ensure all employees feel connected to the company’s mission.

- Celebrate small wins to foster positivity and appreciation during tough times.

Conclusion

The recent market downturn has posed significant challenges for HR and talent departments within fintech companies. From managing cost-cutting measures to retaining top talent and rethinking company culture, HR professionals are relied upon to figure out the best way forward. By collaborating with executive search firms like Aston Fisher, fintech companies can strengthen their talent pipelines and position themselves for long-term success.

Finally, it is important to remember that maintaining a focus on employee well-being, professional development, and strategic talent management is critical. With the right strategies, fintech firms can emerge from this period stronger, more resilient, and better equipped to seize opportunities in the future.